PayMe – Instant Personal Loan App

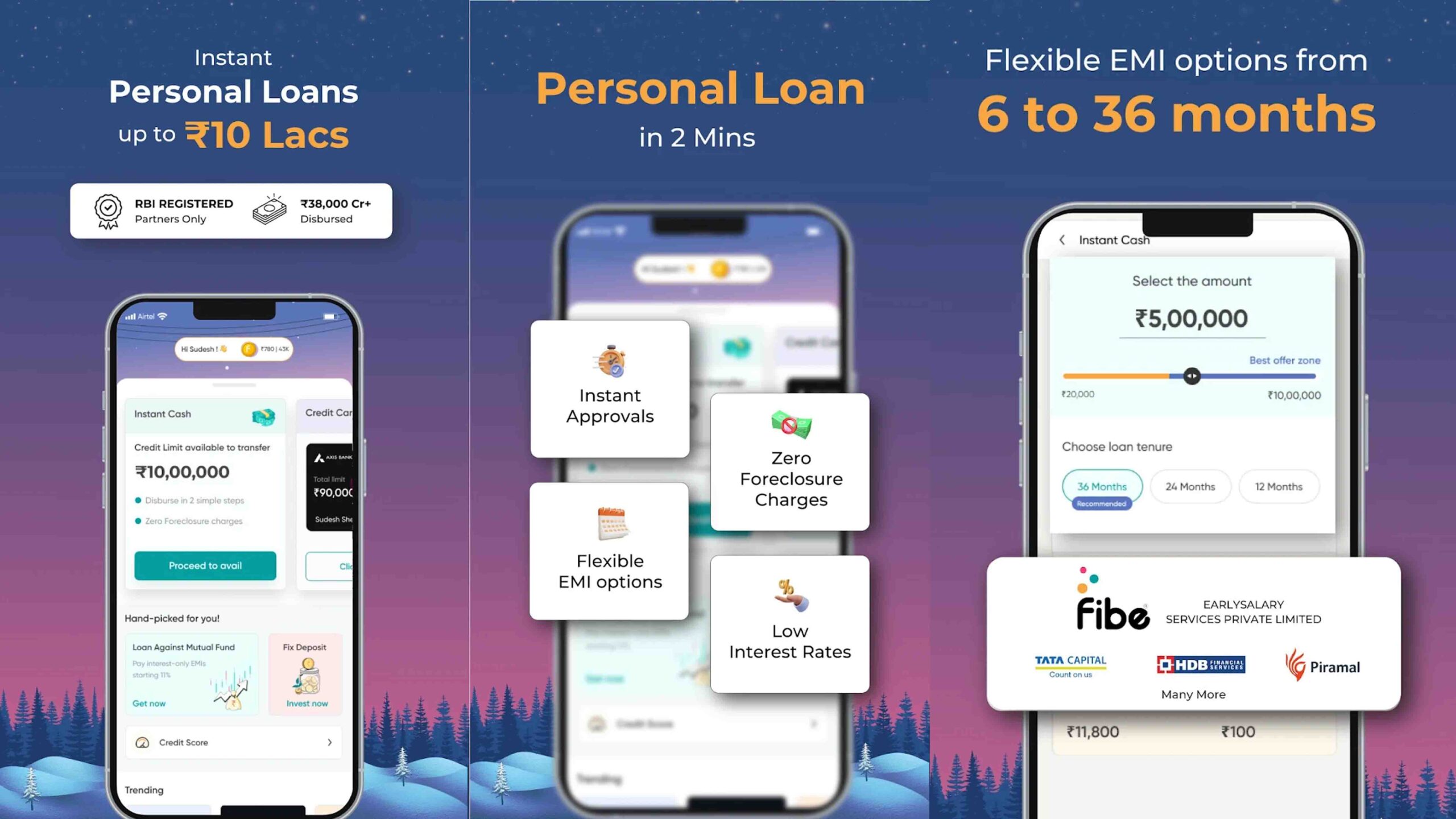

PayMe is a trusted digital lending app with over 6 million users in India. It provides hassle-free personal loans for both salaried and self-employed individuals. Get funds credited to your bank account within a day* using a fully digital, paperless process. PayMe collaborates with RBI-registered NBFCs and banks to offer secure and fast loans.

What You Get with the PayMe Loan App:

– 100% paperless process

– Low processing fees

– Affordable interest rates*

– Loan tenure: 3 to 24 months

– Quick approval and disbursal

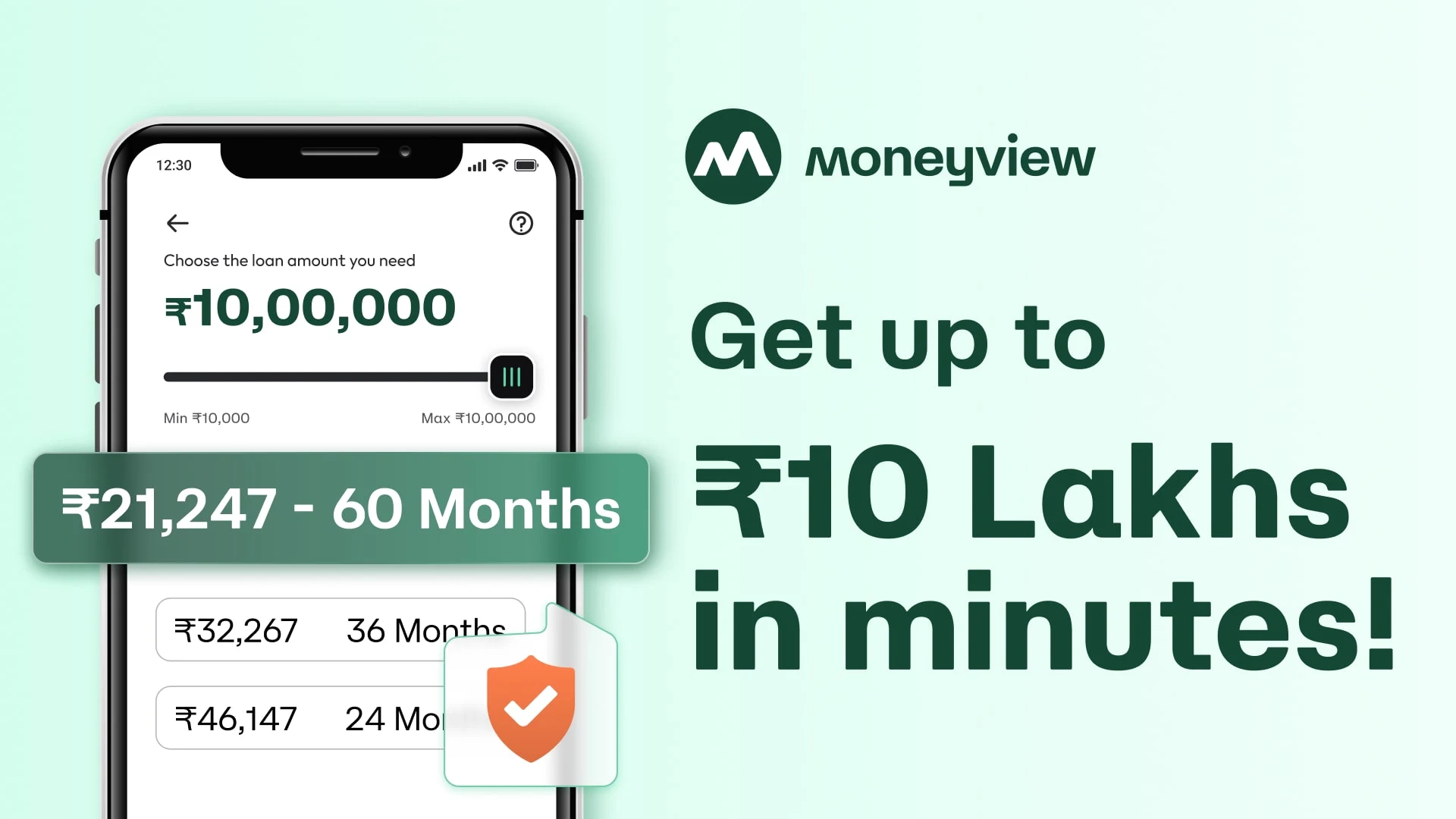

– Instant personal loans up to ₹10 lakhs

Why PayMe Personal Loan App Is Special:

– All-purpose personal loan for education, home renovation, car, medical emergencies, and more

– Completely paperless online loan application

– Fast approval from partnered NBFCs

– Flexible repayment options: One-time repayment or EMIs between 3 and 24 months

– Transparent terms with no hidden charges

– Collateral-free loans

– Free CIBIL score check within the app

Types of Personal Loans Offered:

1. Short-Term Loan (One-Time Repayment)

– Loan up to ₹50,000

– One-time repayment within 90 days

2. EMI Loan

– Loan up to ₹10 lakhs

– Flexible EMIs from 3 to 24 months

3. Empowerment Loan (For Women)

– Special loan program for women

– Tenure of 3 to 24 months

Why PayMe Is Trustworthy:

– Partners only with RBI-registered NBFCs/banks

– High-level data protection using encryption, secured servers, and ISO 27001 certification

Lending Partners:

– Ruloans Financial Services Private Limited

– PayMe India Financial Services Private Limited

– RichCredit Finance Private Limited

– Avanti Finance Private Limited

– Finkurve Financial Services Limited

– Niyogin Fintech Limited

Example: Bullet Loan (One-Time Repayment)

Loan Amount: ₹10,000

Tenure: 90 days

Daily Interest Rate: 0.077%

Total Repayment: ₹10,936

Maximum APR: 115.03%

Example: Term Loan

Loan Amount: ₹30,000

Tenure: 90 days

Daily Interest Rate: 0.10%

Total Cost: ₹33,588

Maximum APR: 74.75%

How to Apply for a PayMe Personal Loan:

1. Install the PayMe Loan App and register via mobile or email

2. Submit KYC documents (Aadhaar and PAN)

3. Get credit limit assigned

4. E-sign the agreement and set up eNACH/eMandate

5. Receive loan amount instantly after approval

Support & Contact:

Website (Eligibility & Docs): www.paymeindia.in/personal-loan/

Customer Support: 0120-697-1400

Address: Logix InfoTech Park D-5, 3rd Floor, Sector 59, Noida, UP – 201301

Privacy Policy: www.paymeindia.in/privacy-policy/

Terms & Conditions: www.paymeindia.in/terms/

*Subject to valid documents, successful verification, and credit approval.