KreditBee – India’s Trusted Personal Loan & UPI App

KreditBee is an online personal loan platform trusted by over 70 million Indians. Get quick personal loans at attractive interest rates with a simple, hassle-free process. Apply online and receive the loan amount directly in your bank account. Whether you are salaried or self-employed, KreditBee gives you easy access to funds anytime, anywhere. You can also enjoy faster, secure, and reliable UPI payments using KreditBee UPI.

Loan Features

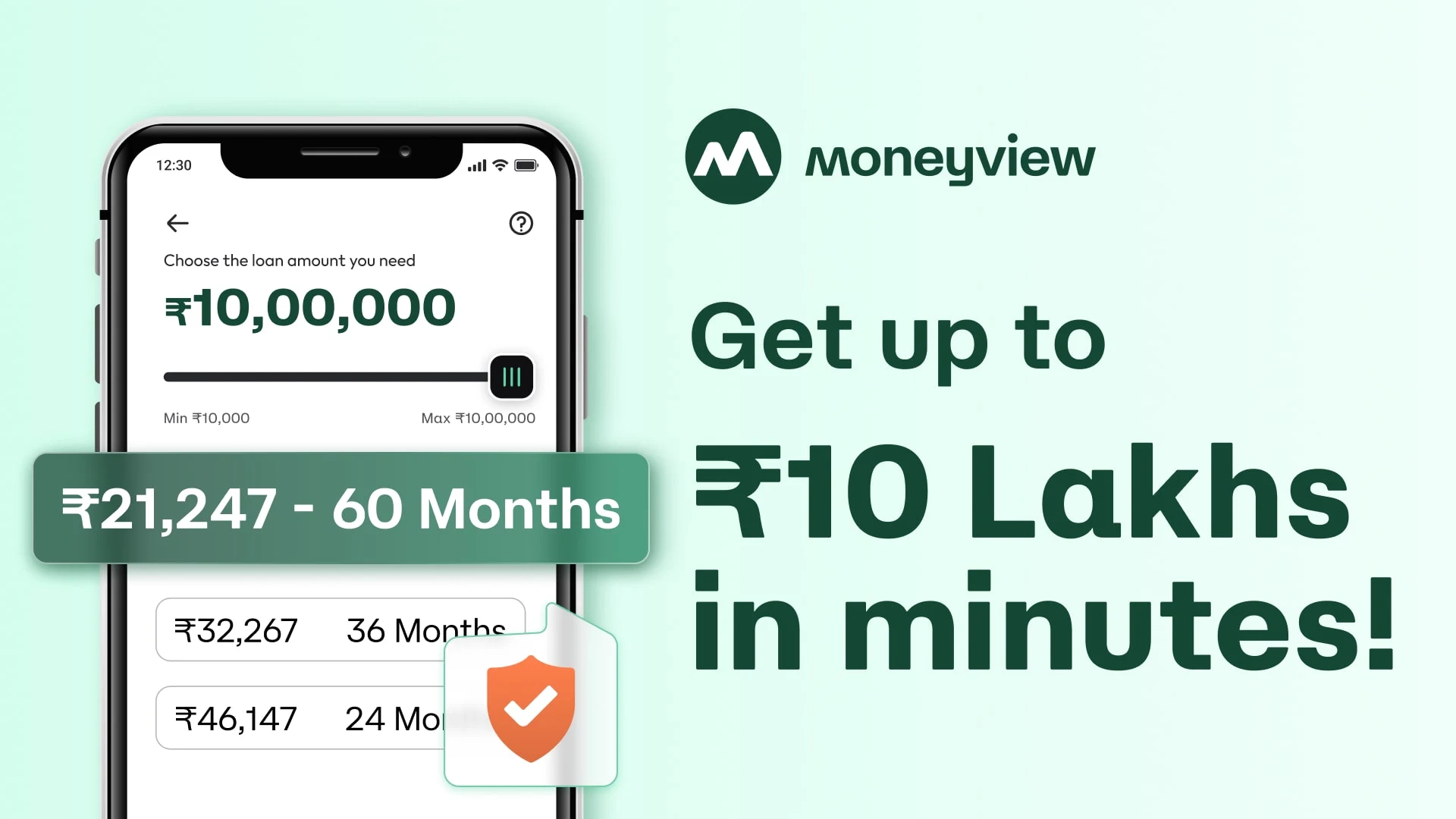

– Loan amount from ₹6,000 to ₹10,00,000

– Interest rates: 12% to 28.5% per annum

– Loan tenure: 6 to 60 months

– APR range: 17% to 50%

– Low transaction fees

– Quick approval and easy EMI

Why Choose KreditBee?

– Quick online loan

– Low interest rates

– Simple and fast application

– Instant loan approval

– Seamless and secure UPI payments

KreditBee UPI (NPCI Approved)

Experience faster and safer payments with KreditBee UPI.

– Create UPI ID by linking your bank account

– Shop online and offline

– Send and receive money instantly

– Fast, secure, and reliable NPCI-approved payment system

Features of KreditBee Personal Loan App

– Quick approval within minutes

– Repayment flexibility with 6 to 60 months

– Fully digital documentation

– 100% transparency with no hidden charges

– Apply anytime, anywhere

– Available in English and Hindi

Loan for Every Purpose

Use KreditBee loans for big purchases, travel, education, weddings, shopping, debt consolidation, home repairs, medical emergencies, and more.

Interest starts from 12% per annum, backed by partnerships with RBI-certified NBFCs and banks.

RBI-Registered Lending Partners:

Krazybee Services Pvt. Ltd.

PayU Finance India Pvt. Ltd.

Oxyzo Financial Services Ltd.

Vivriti Capital Pvt. Ltd.

Cholamandalam Investment and Finance Company Ltd.

Kisetsu Saison Finance (India) Pvt. Ltd.

Tata Capital Ltd.

Northern Arc Capital Ltd.

Piramal Finance Ltd.

MAS Financial Services Ltd.

Mirae Asset Financial Services (India) Pvt. Ltd.

Types of Loans Available:

Personal Loan:

Loan amount from ₹6,000 to ₹10,00,000 with 6–60 months tenure.

Business Loan:

Loan from ₹6,000 to ₹5,00,000 with 6–48 months tenure.

Two-Wheeler Loan:

Loan up to ₹5,00,000 with 6–60 months tenure.

Loan Against Property:

Borrow up to ₹1 Crore with tenure up to 20 years and interest from 12%.

KreditBee 24K Gold:

Buy or sell pure 24K gold instantly.

Example – Personal Loan Calculation:

– Loan Amount: ₹50,000

– Tenure: 12 months

– Interest Rate: 20% p.a.

– Processing Fee: ₹1,250

– Onboarding Fee: ₹200

– GST: ₹261

– Total Interest: ₹5,580

– EMI: ₹4,632

– APR: 26.92%

– Amount Disbursed: ₹48,289

– Total Repayment: ₹55,580

Eligibility:

– Indian citizen

– 21+ years old

– Stable monthly income

How to Apply:

1. Install the KreditBee app

2. Sign up using mobile number

3. Enter PAN & check eligibility

4. Upload KYC documents

5. Select amount & tenure

6. Add bank details

7. Receive loan instantly

Customer Support:

Email: help@kreditbee.in

Phone: 080-44292200 / 080-68534522

Address: 4th Floor, Anjaneya Techno Park, No.147, HAL Old Airport Road, ISRO Colony, Kodihalli, Bengaluru – 560008, Karnataka.

KreditBee – Your Financial Partner for instant loans & secure payments!